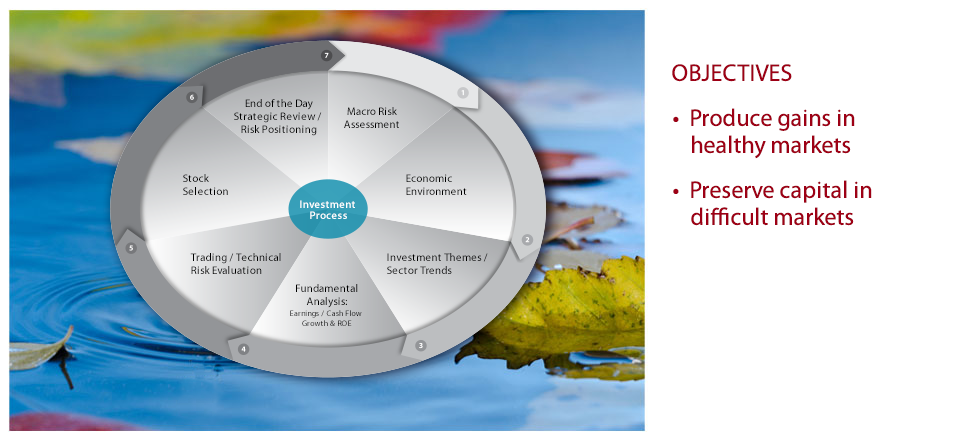

OUR PROCESS.

Set Objectives

Nudge Capital manages a long/short equity portfolio with the objective of producing gains in healthy markets and preserving capital in the more difficult ones.

Risk Appetite

Nudge Capital utilizes credit spreads to monitor any change in the risk appetite of the markets and the levels of rates and slope of the yield curve to better understand the anticipated economic environment.

Harnessing the collective wisdom of the fixed income markets helps us to better focus our fundamental research.

Fundamental Research

Our fundamental research attempts to understand the underlying profitability potential of individual companies. We will gauge the sustainable growth (ROE * Retention) and the recent margin trends to identify companies whose earnings can exceed market expectations.

We will also employ several short strategies to manage either the risk position of our overall portfolio, the risk of an individual holding, or because we see the potential for an investment gain.

Trading Evaluation

Each attractive fundamental idea will be reviewed from a trading perspective by analyzing 5 different technical/trading screens to help us evaluate the overbought/oversold nature of the security and the health of its chart pattern.

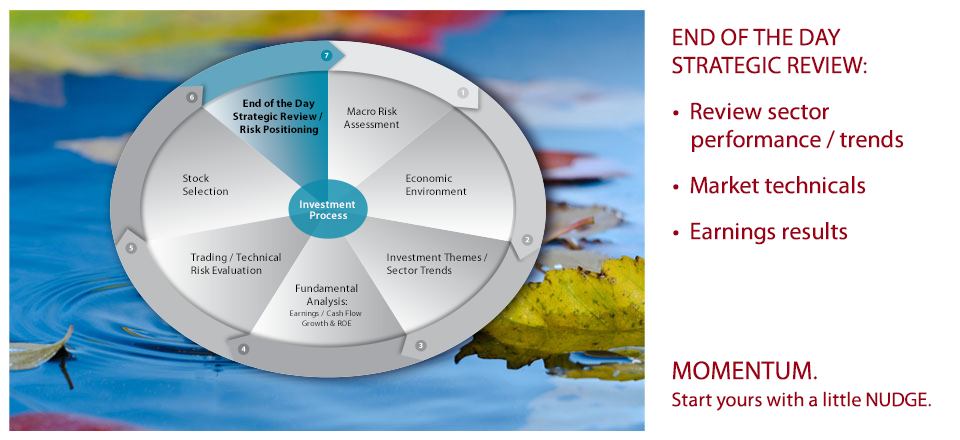

End of Day Strategic Review

Fund performance and attribution will be monitored daily as we strive to find the most efficient balance of stocks and/or options both long and short to manage our risk and achieve our investment objective.